Incoterms 2024: An In-Depth Guide to Meaning Chart & List

In international trade, it is crucial to have a clear understanding of the terms and conditions that govern the sale and transportation of goods. This is where Incoterms come into play. Incoterms, short for International Commercial Terms, are a set of standardized rules created by the International Chamber of Commerce (ICC) to facilitate global trade transactions. These terms define the responsibilities of buyers and sellers in terms of delivery, insurance, customs clearance, and other related aspects.What Are Incoterms?

Incoterms are a set of three-letter trade terms that define the obligations, risks, and costs associated with the delivery of goods from the seller to the buyer. They provide a common language and framework for international trade, ensuring that all parties involved have a clear understanding of their responsibilities and rights.

The latest version of Incoterms is Incoterms 2020, which replaced the previous version, Incoterms 2010. However, in this article, we will be focusing on the upcoming Incoterms 2024, which are still under development and expected to be released in the near future.

The Importance of Incoterms

Incoterms play a vital role in international trade by providing a standardized set of rules that govern the rights and obligations of buyers and sellers. Here are some key reasons why Incoterms are important:

• Clarity and Common Understanding: Incoterms provide a clear and concise framework for international trade transactions. By using standardized terms, all parties involved can have a common understanding of their roles and responsibilities.

• Risk Allocation: Incoterms define which party is responsible for the risk and cost of transportation, insurance, customs clearance, and other related activities. This helps to avoid disputes and ensures that each party knows their obligations.

• Legal Certainty: By using internationally recognized terms, Incoterms provide legal certainty and help to minimize the risk of misunderstandings and disputes between buyers and sellers.

• The Incoterms Chart: Understanding the Different Terms

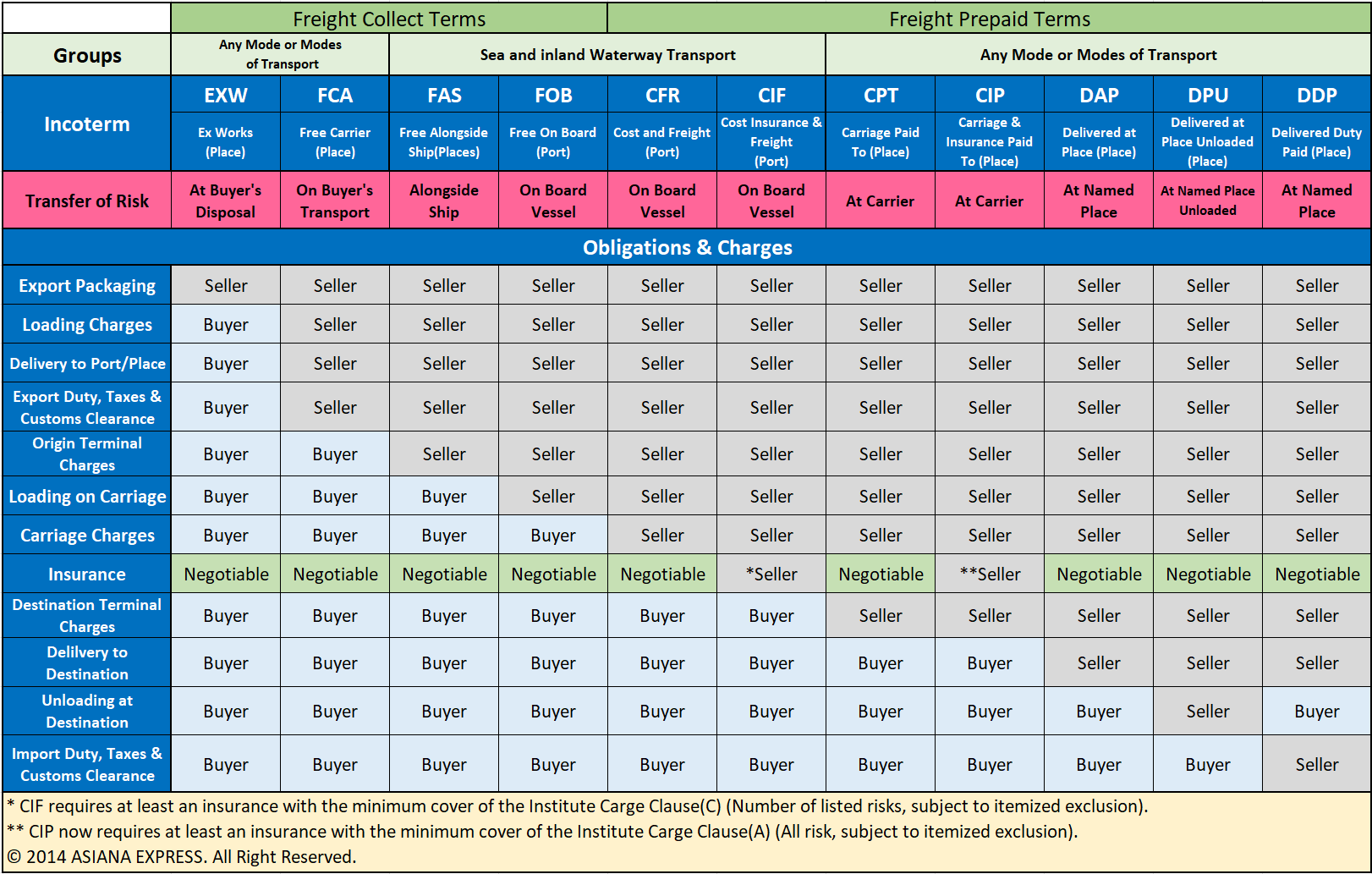

• To better understand the different Incoterms, let's take a closer look at the Incoterms chart. The chart provides a quick reference guide to the various terms and their respective obligations, risks, and costs.

• Each Incoterm represents a different set of obligations for the buyer and seller. It is essential to understand the specific responsibilities associated with each term to ensure a smooth and efficient trade transaction.

• Risk Allocation: Incoterms define which party is responsible for the risk and cost of transportation, insurance, customs clearance, and other related activities. This helps to avoid disputes and ensures that each party knows their obligations.

• Legal Certainty: By using internationally recognized terms, Incoterms provide legal certainty and help to minimize the risk of misunderstandings and disputes between buyers and sellers.

• The Incoterms Chart: Understanding the Different Terms

• To better understand the different Incoterms, let's take a closer look at the Incoterms chart. The chart provides a quick reference guide to the various terms and their respective obligations, risks, and costs.

| Incoterms | Description |

|---|---|

| EXW | Ex Works |

| FCA | Free Carrier |

| CPT | Carriage Paid To |

| CIP | Carriage and Insurance Paid To |

| DAP | Delivered at Place |

| DPU | Delivered at Place Unloaded |

| DDP | Delivered Duty Paid |

| FAS | Free Alongside Ship |

| FOB | Free on Board |

| CFR | Cost and Freight |

| CIF | Cost, Insurance, and Freight |

• Each Incoterm represents a different set of obligations for the buyer and seller. It is essential to understand the specific responsibilities associated with each term to ensure a smooth and efficient trade transaction.

Key Considerations When Choosing an Incoterm

When selecting an Incoterm for a trade transaction, several factors should be taken into consideration. Here are some key considerations to keep in mind:

• Mode of Transportation: The chosen Incoterm should be suitable for the mode of transportation used for shipping the goods. Some terms are more suitable for sea freight, while others are more applicable to air or land transportation.

• Risk Allocation: Consider the risk and cost allocation between the buyer and seller. Some terms place more responsibility on the seller, while others transfer more risk and cost to the buyer.

• Insurance Coverage: Determine the level of insurance coverage required for the goods during transportation. Some terms include insurance, while others require the buyer or seller to arrange insurance separately.

• Customs Clearance: Consider the obligations and responsibilities related to customs clearance and import/export documentation. Some terms require the seller to handle customs procedures, while others place the responsibility on the buyer.

• Risk Allocation: Consider the risk and cost allocation between the buyer and seller. Some terms place more responsibility on the seller, while others transfer more risk and cost to the buyer.

• Insurance Coverage: Determine the level of insurance coverage required for the goods during transportation. Some terms include insurance, while others require the buyer or seller to arrange insurance separately.

• Customs Clearance: Consider the obligations and responsibilities related to customs clearance and import/export documentation. Some terms require the seller to handle customs procedures, while others place the responsibility on the buyer.

Common Incoterms Misconceptions

Despite the efforts to standardize and simplify international trade, there are still some misconceptions and misunderstandings surrounding Incoterms. Here are some common misconceptions:

• Incoterms Determine Ownership: Incoterms do not determine the ownership of goods; they only define the responsibilities and obligations of the buyer and seller regarding the delivery and transportation of goods.

• Incoterms Cover All Aspects of a Trade Transaction: Incoterms primarily focus on the delivery of goods and transportation-related obligations. They do not cover other aspects such as payment terms, intellectual property rights, or contractual terms and conditions.

• Incoterms Are Universal: While Incoterms are widely recognized and used in international trade, they are not universally applicable. The choice of Incoterm depends on the specific trade transaction, the parties involved, and the applicable laws and regulations.

• EXW - Ex Works

• The Ex Works (EXW) Incoterm places the maximum responsibility on the buyer. Under EXW, the seller's obligation is to make the goods available at their premises, such as a factory or warehouse. The buyer assumes all costs and risks from that point forward, including transportation, export/import clearance, and insurance.

• FCA - Free Carrier

• The Free Carrier (FCA) Incoterm requires the seller to deliver the goods to a carrier named by the buyer at a specified location, such as a terminal or warehouse. The risk transfers to the buyer once the goods are handed over to the carrier. The seller is responsible for export clearance, while the buyer assumes responsibility for transportation, import clearance, and insurance.

• CPT - Carriage Paid To

• The Carriage Paid To (CPT) Incoterm involves the seller arranging and paying for the transportation of goods to a named destination. The risk transfers to the buyer once the goods are delivered to the agreed-upon destination. The seller is responsible for export clearance, while the buyer assumes responsibility for import clearance and insurance.

• CIP - Carriage and Insurance Paid To

• Similar to CPT, the Carriage and Insurance Paid To (CIP) Incoterm requires the seller to arrange and pay for transportation to a named destination. Additionally, the seller must also arrange and pay for insurance coverage in case of loss or damage to the goods during transit. The risk transfers to the buyer upon delivery, and the buyer assumes responsibility for import clearance.

• DAP - Delivered at Place

• Under the Delivered at Place (DAP) Incoterm, the seller is responsible for arranging the entire shipment and delivering the goods to a named place agreed upon by both parties. The risk transfers to the buyer upon delivery. While the seller is responsible for clearing goods for export, the buyer assumes responsibility for import customs duties, fees, and taxes.

• DPU - Delivered at Place Unloaded

• The Delivered at Place Unloaded (DPU) Incoterm requires the seller to arrange the shipment and deliver the goods to a named place. Additionally, the seller is responsible for unloading the goods. The risk transfers to the buyer once the goods are unloaded. The buyer assumes responsibility for import clearance and other associated costs.

• DDP - Delivered Duty Paid

• The Delivered Duty Paid (DDP) Incoterm places the maximum responsibility on the seller. The seller is responsible for the entire shipment, including customs clearance and fees, and delivering the goods to the buyer's premises. This Incoterm relieves the buyer from any further obligations once the goods are delivered.

• FAS - Free Alongside Ship

• The Free Alongside Ship (FAS) Incoterm requires the seller to deliver the goods to a named port of shipment and place them alongside the ship. The risk transfers to the buyer when the goods are placed alongside the ship. The buyer assumes responsibility for the main leg of transit and every other step in the delivery process.

• FOB - Free On Board

• The Free On Board (FOB) Incoterm places the responsibility for packaging, pickup, and delivery of goods onto a vessel at the port of shipment on the seller. The liability transfers to the buyer once the goods are on board the vessel. The buyer assumes responsibility for every other step of the journey.

Also read:

• CFR - Cost and Freight

• The Cost and Freight (CFR) Incoterm requires the seller to arrange and pay for transportation to the port of origin and for loading the goods onto the vessel. The seller is also responsible for transportation to the destination port, but they are not liable for that portion of the journey. The risk transfers to the buyer when the goods are boarded at the origin port.

• CIF - Cost, Insurance, and Freight

• Similar to CFR, the Cost, Insurance, and Freight (CIF) Incoterm involves the seller arranging and paying for transportation to the port of destination. However, with CIF, the seller must also arrange and pay for insurance coverage for the goods during transit. The risk transfers to the buyer upon boarding at the origin port.

• Incoterms Cover All Aspects of a Trade Transaction: Incoterms primarily focus on the delivery of goods and transportation-related obligations. They do not cover other aspects such as payment terms, intellectual property rights, or contractual terms and conditions.

• Incoterms Are Universal: While Incoterms are widely recognized and used in international trade, they are not universally applicable. The choice of Incoterm depends on the specific trade transaction, the parties involved, and the applicable laws and regulations.

• EXW - Ex Works

• The Ex Works (EXW) Incoterm places the maximum responsibility on the buyer. Under EXW, the seller's obligation is to make the goods available at their premises, such as a factory or warehouse. The buyer assumes all costs and risks from that point forward, including transportation, export/import clearance, and insurance.

• FCA - Free Carrier

• The Free Carrier (FCA) Incoterm requires the seller to deliver the goods to a carrier named by the buyer at a specified location, such as a terminal or warehouse. The risk transfers to the buyer once the goods are handed over to the carrier. The seller is responsible for export clearance, while the buyer assumes responsibility for transportation, import clearance, and insurance.

• CPT - Carriage Paid To

• The Carriage Paid To (CPT) Incoterm involves the seller arranging and paying for the transportation of goods to a named destination. The risk transfers to the buyer once the goods are delivered to the agreed-upon destination. The seller is responsible for export clearance, while the buyer assumes responsibility for import clearance and insurance.

• CIP - Carriage and Insurance Paid To

• Similar to CPT, the Carriage and Insurance Paid To (CIP) Incoterm requires the seller to arrange and pay for transportation to a named destination. Additionally, the seller must also arrange and pay for insurance coverage in case of loss or damage to the goods during transit. The risk transfers to the buyer upon delivery, and the buyer assumes responsibility for import clearance.

• DAP - Delivered at Place

• Under the Delivered at Place (DAP) Incoterm, the seller is responsible for arranging the entire shipment and delivering the goods to a named place agreed upon by both parties. The risk transfers to the buyer upon delivery. While the seller is responsible for clearing goods for export, the buyer assumes responsibility for import customs duties, fees, and taxes.

• DPU - Delivered at Place Unloaded

• The Delivered at Place Unloaded (DPU) Incoterm requires the seller to arrange the shipment and deliver the goods to a named place. Additionally, the seller is responsible for unloading the goods. The risk transfers to the buyer once the goods are unloaded. The buyer assumes responsibility for import clearance and other associated costs.

• DDP - Delivered Duty Paid

• The Delivered Duty Paid (DDP) Incoterm places the maximum responsibility on the seller. The seller is responsible for the entire shipment, including customs clearance and fees, and delivering the goods to the buyer's premises. This Incoterm relieves the buyer from any further obligations once the goods are delivered.

• FAS - Free Alongside Ship

• The Free Alongside Ship (FAS) Incoterm requires the seller to deliver the goods to a named port of shipment and place them alongside the ship. The risk transfers to the buyer when the goods are placed alongside the ship. The buyer assumes responsibility for the main leg of transit and every other step in the delivery process.

• FOB - Free On Board

• The Free On Board (FOB) Incoterm places the responsibility for packaging, pickup, and delivery of goods onto a vessel at the port of shipment on the seller. The liability transfers to the buyer once the goods are on board the vessel. The buyer assumes responsibility for every other step of the journey.

Also read:

• CFR - Cost and Freight

• The Cost and Freight (CFR) Incoterm requires the seller to arrange and pay for transportation to the port of origin and for loading the goods onto the vessel. The seller is also responsible for transportation to the destination port, but they are not liable for that portion of the journey. The risk transfers to the buyer when the goods are boarded at the origin port.

• CIF - Cost, Insurance, and Freight

• Similar to CFR, the Cost, Insurance, and Freight (CIF) Incoterm involves the seller arranging and paying for transportation to the port of destination. However, with CIF, the seller must also arrange and pay for insurance coverage for the goods during transit. The risk transfers to the buyer upon boarding at the origin port.